If you’re in the market for the right investment strategy, then you might have come across margin trading. Before you start taking advantage of this type of trading, it’s important to understand what it is and how it can benefit you.

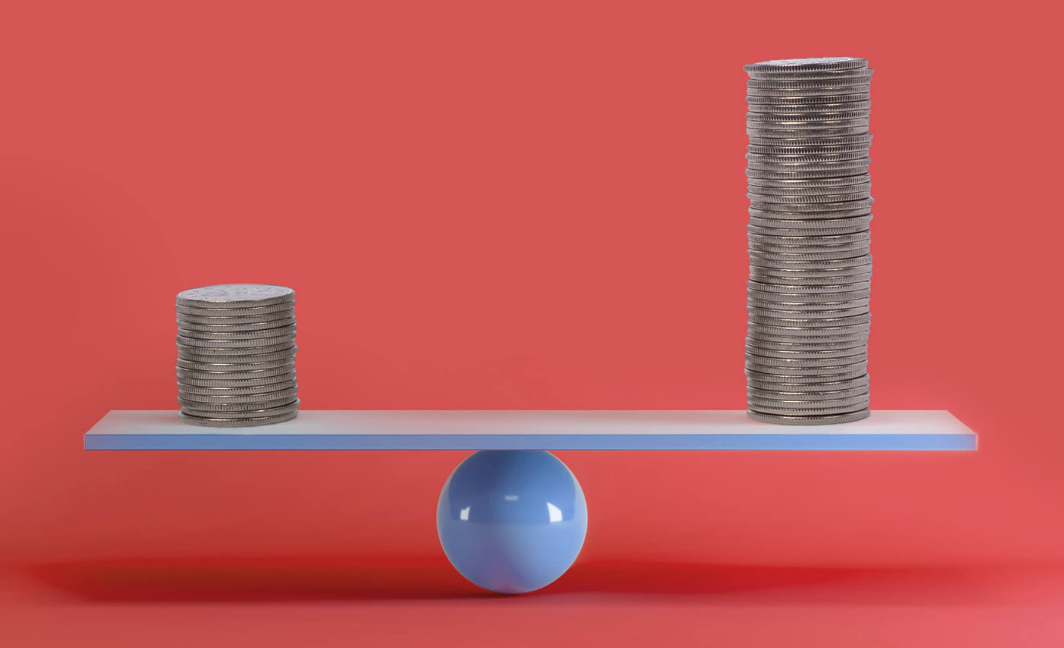

Unlike traditional trading, margin investing is not about what you trade. It’s about how you trade. This type of investing can give you more flexibility and allow you to trade on a more consistent basis. According to the experts at SoFi, “When it comes to trading and investing, the margin is the borrowed money that some traders use to execute their strategy. Buying assets on margin can help magnify your gains and returns — but it can do the same with your losses.”

What Are Margin Accounts?

Unlike investment security, a margin account isn’t a type of financial instrument that’s commonly used to purchase stocks. Instead, it’s money that you borrow to invest in a specific security. This type of loan is similar to a mortgage, except that you’re borrowing money to buy stocks instead of taking out a home loan.

How Does Margin Trading Work?

Before you can start investing in stocks, you’ll first need to establish a margin account with your brokerage. This type of loan is different from a cash account that you might use to trade other investments. The minimum deposit you must make to open a margin account is $2,000. However, you can increase your deposit amount in time.

The ability to borrow money from the broker to purchase stocks increases your buying power because you’re not only using your own money, but you also need to borrow from the broker to cover the costs associated with the transaction. If you’re not comfortable with a 50% margin, you can opt for a smaller loan of around 10 or 20%.

Once you have a sufficient amount of marginal securities in your account, you can start to leverage these assets for additional loans. This type of loan allows you to purchase additional stocks based on the value of your stocks.

What Is a Margin Call?

A margin call is a type of loan your broker can give you to increase the amount of cash you’re holding in your account. It can happen after the equity value of your account falls below a certain threshold.

Although your broker might not be obligated to notify you about a margin call, they can still ask you to deposit to increase the amount of cash that they have in your account. If you don’t respond to the broker’s call, they can sell the company shares they’re buying in your account to make up the difference.

How To Minimize Risks Associated with Margin Trading?

One of the most important factors you should consider is losing money due to a margin call. If you’re a novice investor or rely on a professional to manage your investments, then margin borrowing may not be the best option.

To minimize the risks associated with margin borrowing, try diversifying your investments by investing in different types of stocks. You can also use a margin account to trade in foreign exchanges.

Before you start using a margin account, make sure that you have enough cash in your account to handle any margin calls that might occur.