Do you use doji candlestick patterns? If you do, you are not alone. This article will teach you how to recognize the Dragonfly, Long-legged, and Bullish doji candlestick patterns. You will also learn about the Haramidoji. These patterns are often considered bullish and are a good signal for entering a trade. However, you should not make a decision based on the candlestick pattern alone. Candlestick patterns are not always the best indicator of price targets and require other trading tools to help you decide when to exit a trade.

Long-legged doji:

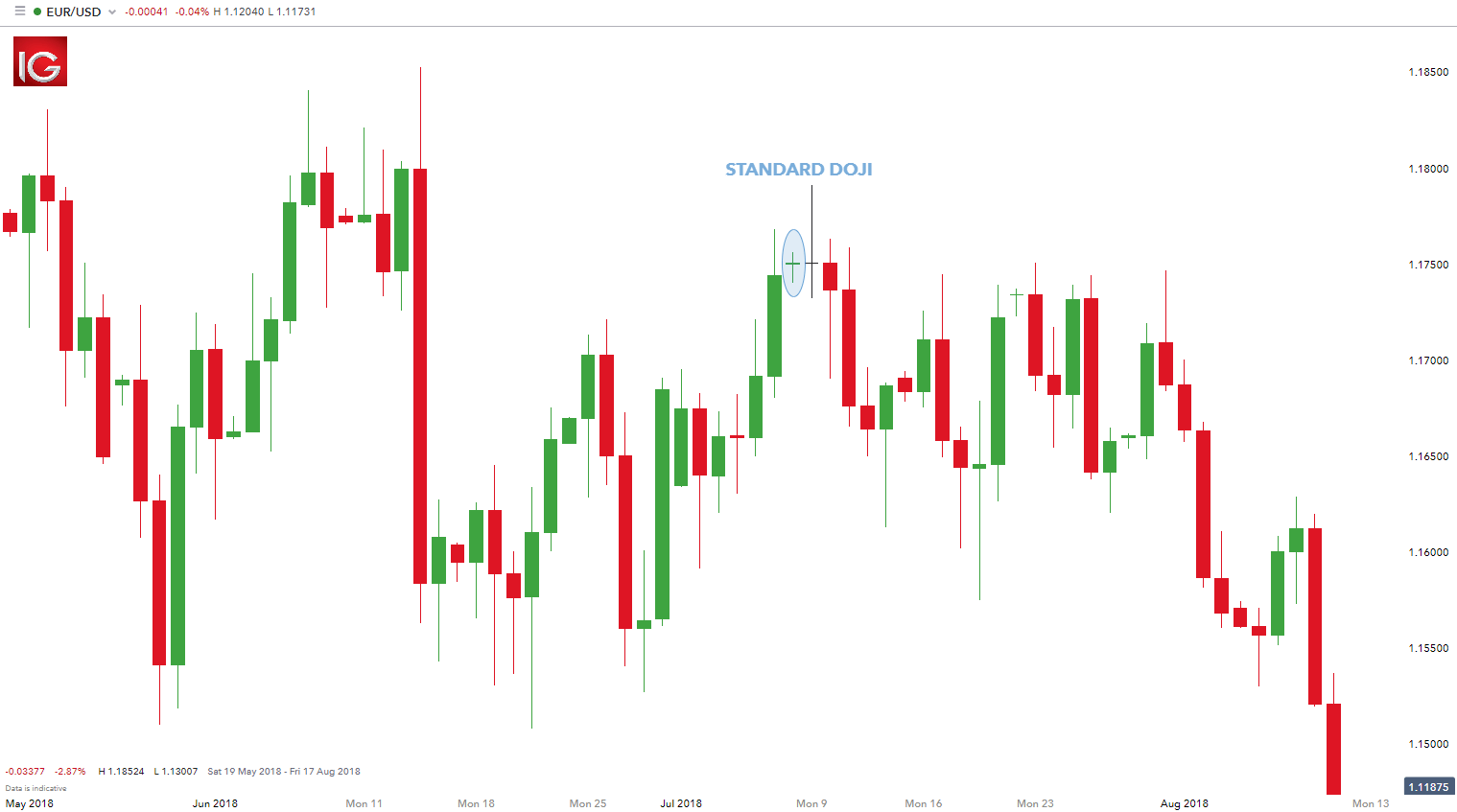

One of the candlestick patterns with the highest chances of forming is the Doji candlestick patterns. This pattern can occur on any timeframe and in any trend, but is most useful when it appears at the top or bottom of a trend. Here’s how to spot this candlestick pattern:

This candlestick pattern appears when the body of the candle is at the middle. It resembles a long line. The wicks and shadows of the candle are called the “long legs.” The body of the candle is small. This is a strong indication that a trend reversal may be in the works. It can be a good time to exit a long position or take a short position, depending on the direction the trend is taking.

Dragonfly doji:

When the price of an asset prints a dragonfly candlestick pattern, this is a sign that it may turn around and begin a new upward trend. This pattern has the same high and low prices and occurs on all timeframes. It is often black in color or a neutral color. When it appears, traders should consider buying if the security’s price has a long lower shadow.

When trading dragonfly dojis, be aware of the size and shape of the wick. The high of the dragonfly doji must be a small one to three pip higher than the body of the candle. Dragonfly dojis are also a warning of a trend reversal. The formation may occur after a strong upward trend for a stock. The resulting candlestick pattern may indicate that this upward trend will soon come to a halt, or that it will begin to trend down over the next period.

Harami:

Bullish Harami candlestick patterns are characterized by a bullish first candle and a bearish second candle. The harami pattern is made up of two candles, one large and bearish and the other smaller and bullish. They resemble the form of a pregnant woman. In fact, the term “harami” means “pregnancy” in Japanese. In order to identify this pattern, first determine which direction the market is moving.

The bullish Harami Cross is typically formed at the bottom of a market. The opposite sentiment is conveyed when the doji occurs. The doji occurs when the market is indecisive. The first short candle is bullish and the second is bearish, so this pattern may signal a reversal in the trend. However, there are many other patterns to watch out for that indicate that a market is in a bearish trend.

Bullish doji:

Doji candlestick patterns occur when price opens and closes at the same level. These patterns usually occur after a trading session and indicate that the price was unable to find equilibrium at another level. Bullish traders often use this pattern to buy stocks. Bearish traders use it to sell stocks. The best time to trade a Doji is after a market reaches a resistance level and begins to reverse. These patterns occur during periods of high volatility and are best used in combination with other technical indicators. If you want the best newsfeed visit https://answersherald.com/

To identify these patterns, you must first determine which type of doji you’re looking for. Bullish doji patterns can occur on several timeframes, and you’ll need to choose the right one for your trading strategy. You’ll want to look for long legs, as these signify that the market is highly fluctuating. The Gravestone and Dragonfly dojis are two types of Doji, and they indicate downward and upward movement, respectively. The common Doji, on the other hand, indicates a high risk of a reversal, but they’re not necessarily a signal for a new trend.